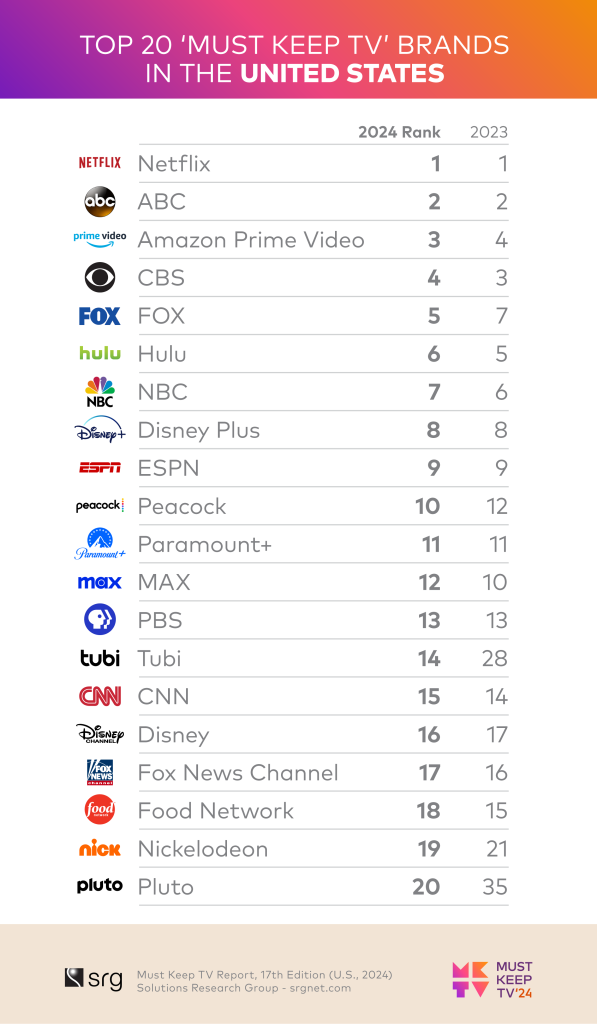

Netflix once again tops the must keep list in 2024 for the fifth year in a row, solidifying its presence as the leading ‘Must Keep’ TV brand in the U.S., according to the 17th annual ‘Must Keep TV’ Report from Solutions Research Group (SRG).

The 2024 research is based on 1,400 interviews across the U.S. with consumers aged 12 and older and conducted in May 2024.

ABC, Prime Video, CBS and FOX follow Netflix as the top 5 leading brands – ABC is remarkably hanging on to its #2 position since 2020, just behind Netflix. Hulu, NBC, Disney+, ESPN and, Peacock round out this year’s top 10 list. ESPN is in the #9 position overall and the only cable channel in the Top 10; Peacock is a new entrant in this year’s Top 10, elbowing out Max which dropped to the #12 spot this year.

FREE STREAMING SURGING: TUBI AND PLUTO ARE BOTH NOW IN THE TOP 20

Last year, the leading ‘FAST’ streaming brands Tubi and Pluto entered the rankings at #28 and #35; this year Tubi is ranked #14 (up 14 spots) and Pluto is ranked #20 (up 15 spots) – a level of increase in popularity we have not seen for any brand in some years.

This said, there are some other brands showing positive momentum in 2024 as well and these include Nickelodeon (back in the top 20), Comedy Central (#21, up three spots from 2022), National Geographic (#25 up from #31), Apple TV+ (#26, its highest position in four years), MTV and ION.

Brands losing steam this year include Max (dropped out of Top 10 to #12 position), History (out of the top 20 for the first time in the last ten years), CW (#23, lowest rank in ten years), Discovery (#24, lowest rank in ten years), HGTV (out of the top 20) and TLC (lowest rank since 2018).

AMONG 18-34s, THERE ARE 4 STREAMERS IN THE TOP 5: NETFLIX, HULU, PRIME VIDEO AND DISNEY PLUS

Netflix maintains the #1 spot for the eighth year in a row in this young adult demo. Netflix is followed by Hulu, Amazon Prime Video, Disney Plus And ABC, the sole network in the top 5. Rounding out the top 10 are Max, FOX, ESPN, CBS and Peacock.

AMONG MEN 18-49, TOP 5 CONSISTS OF NETFLIX, ABC, ESPN, FOX and HULU

Top 10 brands among Men 18-49 in 2024 were stable vs. 2023 except for minor rank changes. Rounding the top 10 were Prime Video, CBS, Disney Plus, NBC and Max. Peacock and Paramount+ were just outside the Top 10, coming in at #11 and #12 respectively as they did in 2023. Tubi skyrocketed in rankings from #40 to #13 coming in just after Paramount+ and Pluto also jumped, from #48 to #25.

AMONG WOMEN 25-54, A RECORD 7 OF THE TOP 10 ‘MUST KEEP’ BRANDS IN 2024 ARE STREAMERS; ABC, FOX, AND CBS STILL IN THE MIX

Netflix, Prime Video, Hulu, Disney Plus and ABC are the top brands for women 25-54. Paramount+ entered the Top 10 for this demo in the #6 position, up from #11 last year. Rounding the top 10 are FOX, Peacock, Max and CBS.

TUBI JOINS LEADING STREAMERS AND NETWORKS IN THE TOP 10 AMONG AFRICAN-AMERICAN AUDIENCES

Netflix topped the charts for African-American audiences in 2024 followed by ABC, Prime Video, Hulu and Tubi, entering in #5, up 12 spots from last year’s #17 rank. BET regained its Top 10 ranking this year coming in at #7. ESPN re-entered the Top 10 this year and Paramount+ is in the Top 10 for the first time.

Within the Latinx audience, Netflix was the top streamer and ABC was the top network as #2 Must Keep brand, followed by Hulu, Prime Video and Disney Plus. Rounding out the Top 10 was FOX, CBS, ESPN, Univision and Peacock. Peacock entered into the Top 10 for the first time in this segment, up from #14 last year. Univision came in at #9 for the Latinx audience, Telemundo was ranked #13 this year.

Technical: ‘Must Keep TV’ is an independent syndicated brand tracking survey conducted by Solutions Research Group (SRG) among a representative sample of American consumers. This is the 17th edition of the survey since 2007. The questions have been fielded and presented in a consistent manner each year. The 2024 research is based on online interviews with 1,400 American consumers aged 12 and older and conducted in May 2024 – the sample captures and represents all major population segments. Respondents are shown a list of 83 broadcast, cable and high-penetration streaming brands and are asked to identify which ones would be on their ‘must keep TV’ list if they had to choose a limited number. Sample design is inclusive and is balanced by geography, gender and ethnicity, according to known universe parameters for the U.S. population. For more, contact robin@srgnet.com